Introduction

The COVID-19 pandemic has had a ripple effect on various aspects of life, from health to the economy. One might assume that the financial hardships faced during these times would negatively impact child support and spousal support payments. However, a relatively recent Report from Statistics Canada regarding Child Support and Spousal Support Payments presents a different narrative.

Statistics Canada Survey

The Survey of Maintenance Enforcement Programs (SMEP), spearheaded by Statistics Canada, gathers data on child and spousal support cases and payments from provincial and territorial maintenance enforcement programs (MEPs). Authorized under the Family Maintenance Act, MEPs are responsible for managing support obligations in accordance with court orders or agreements. Once an agreement or order is registered with a MEP, the paying party is required to send the support payment to the MEP instead of directly to the recipient. The MEP then handles the transaction, keeps a financial record, and forwards the payment to the intended recipient.

It’s important to note that the data only includes information from jurisdictions that actively report to the SMEP, which are Newfoundland and Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Saskatchewan, Alberta, Yukon, and the Northwest Territories. Notably, the data does not include information from Ontario or Quebec.

Key Highlights Re: Child Support and Spousal Support Payments

- 84% of child and spousal support payments were collected in 2020/2021.

- New Brunswick and Prince Edward Island reported a 100% total payment collection rate for support cases.

- Saskatchewan had the lowest rate among reporting jurisdictions (77%).

- Support Payments Rise Despite Pandemic

An Increase in Child Support and Spousal Support Payments

Contrary to what one might expect, the year 2020/2021 saw an 84% collection rate for child and spousal support payments, marking a 3 percentage point increase from the previous year. This is notable because it is the largest year-over-year increase in three years.

Behind the Numbers

The report attributes this surprising stability to various government assistance programs and payor relief measures that were put in place in response to the pandemic. These measures helped Canadians deal with financial hardships, thus enabling them to continue making their support payments.

Regional Variances

The Highs

Both New Brunswick and Prince Edward Island reported a 100% total payment collection rate for support cases, setting a benchmark for other provinces.

The Lows

On the flip side, Saskatchewan had the lowest rate among reporting jurisdictions, with a 77% collection rate. This indicates a need for more robust maintenance enforcement programs in certain regions.

Age and Gender: A Closer Look at Compliance Rates

Women Over 65 Lead the Pack

The report uncovers fascinating data when it comes to age and gender. Women over 65 had an impressive 100% payment compliance rate. This could be attributed to various factors, such as financial stability at this age or fewer overall obligations.

Younger Men Lag Behind

In contrast, men aged 15-44 had the lowest compliance rates, at 80%. The data suggests that younger payors might face more financial instability, warranting further investigation and potential intervention.

Arrears in Child Support and Spousal Support Payments

Starting with a Backlog

Nearly two-thirds of cases started the fiscal year with arrears. This suggests that many are already behind on their payments, adding another layer of complexity to the enforcement of support payments.

A Glimmer of Hope

However, it’s not all doom and gloom. Over half of the cases that started with arrears saw their backlogs decrease by the end of the year. While this is encouraging, it also emphasizes the need for robust enforcement and support measures.

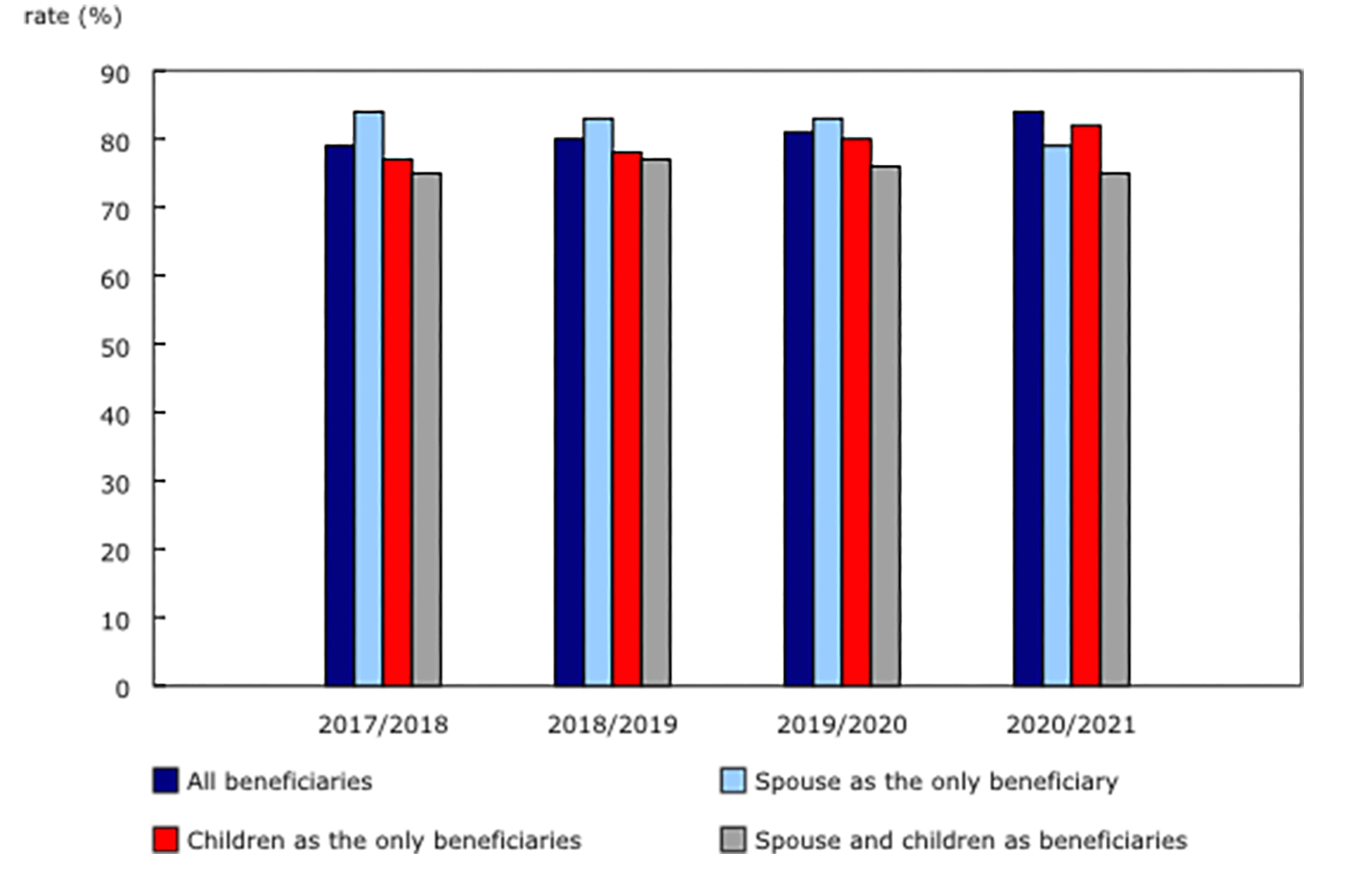

Beneficiary Type and Compliance

Child-Only Cases Fare Better

When breaking down the data by beneficiary type, cases with only child beneficiaries had a higher payment collection rate (82%) compared to those with spousal beneficiaries (79%) or both (75%).

What This Means

The variance in payment rates based on the type of beneficiary could be indicative of societal attitudes towards child support vs. spousal support, or it could highlight differences in enforcement efficacy.

Payment Collection Rates by Beneficiary Type

Source: Statistics Canada

Future Prospects for Child Support and Spousal Support Payments

The resilience shown in child and spousal support payments amidst a pandemic is heartening, but it also highlights the importance of government support programs in ensuring financial stability for families. With more data becoming available for subsequent years, it will be intriguing to see if these trends continue.

Final Thoughts

The report from Statistics Canada provides valuable insights into the resilience of Canadians in fulfilling their child and spousal support obligations, even in the face of a global pandemic. It offers hope for future stability, provided that adequate support systems are in place.

The commitment to support payments, as shown by these statistics, underscores the collective responsibility we share in ensuring the well-being of our families, particularly in times of crisis.

To learn more about trends relating to divorce, check out my article Understanding Divorce Statistics and Trends in Canada.

Join us on LinkedIn and stay connected.

Cheryl Goldhart is a mediator and arbitrator who can make a difference:

-

- Practising family law exclusively for nearly 40 years, Cheryl brings expertise and experience to each case.

- Her Master’s degree in Counseling complements her legal acumen, creating a nuanced approach that emphasizes compassion and insight when navigating family conflicts.

- Cheryl is recognized by the Law Society of Ontario as a Family Law Specialist.

- She is also an family mediator accredited by the Ontario Association for Family Mediation.

- As an arbitrator, Cheryl has earned the designation of ADR Professional from the ADR Institute of Ontario.

- Her remarkable work in the area of family law has garnered her numerous accolades including the prestigious Ontario Bar Association’s Award for Excellence in Family Law.

Legal Disclaimer: Please review our Privacy Policy.